Information and choice: nine reasons our future is in the balance

December 3, 2013 10 Comments

(The Bandra pedestrian skywalk in Mumbai, photo taken from the Collaborative Research Initiative Trust‘s study of Mumbai, “Being Nicely Messy“, produced for the 2012 Audi Urban Futures awards)

The 19th and 20th centuries saw the flowering and maturation of the Industrial Revolution and the creation of the modern world. Standards of living worldwide increased dramatically as a consequence – though so did inequality.

The 21st century is already proving to be different. We are reaching the limits of supply of the natural resources and cheap energy that supported the last two centuries of development; and are starting to widely exploit the most powerful man-made resource in history: digital information.

Our current situation isn’t simply an evolution of the trends of the previous two centuries; nine “tipping points” in economics, society, technology and the environment indicate that our future will be fundamentally different to the past, not just different by degree.

Three of those tipping points represent changes that are happening as the ultimate consequences of the Industrial Revolution and the economic globalisation and population growth it created; three of them are the reasons I think it’s accurate to characterise the changes we see today as an Information Revolution; and the remaining three represent challenges for us to face in the future.

The difficulty faced in addressing those challenges internationally through global governance institutions is illustrated by the current status of world trade deal and climate change negotiations; but our ability to respond to them is not limited to national and international governments. It is in the hands of businesses, communities and each of us as individuals as new business models emerge.

The structure of the economy is changing

In 2012, the Collaborative Research Initiatives Trust were commissioned by the Audi Urban Futures Awards to develop a vision for the future of work and life in Mumbai. In the introduction to their report, “Being Nicely Messy“, they cite a set of statistics describing Mumbai’s development that nicely illustrate the changing nature of the city:

“While the population in Mumbai grew by 25% between 1991 and 2010, the number of people travelling by trains during the same years increased by 66% and the number of vehicles grew by 181%. At the same time, the number of enterprises in the city increased by 56%.

All of this indicates a restructuring of the economy, where the nature of work and movement has changed.”

(From “Being Nicely Messy“, 2011, Collaborative Research Initiatives Trust)

Following CRIT’s inspiration, over the last year I’ve been struck by several similar but more widely applicable sets of data that, taken together, indicate that a similar restructuring is taking place across the world.

(Professor Robert Gordon’s analysis of historic growth in productivity, as discussed by the famous investor Jeremy Grantham, showing that the unusual growth experienced through the Industrial Revolution may have come to an end. Source: Gordon, Robert J., “Is U.S. Economic Growth Over? Faltering Innovation Confronts the Six Headwinds,” NBER Working Paper 18315, August 2012)

The twilight of the Industrial Revolution

Tipping point 1: the slowing of economic growth

According to the respected investor Jeremy Grantham, Economic growth has slowed systemically and permanently. He states that: “Resource costs have been rising, conservatively, at 7% a year since 2000 … in a world growing at under 4% and [in the] developed world at under 1.5%”

Grantham’s analysis is that the rapid economic growth of the last century was a historical anomaly driven by the productivity improvements made possible through the Industrial Revolution; and before that revolution reached such a scale as to create global competition for resources and energy. Property and technology bubbles extended that growth into the early 21st Century, but it has now reduced to much more modest levels where Grantham expects it to remain. The economist Tyler Cowan came to similar conclusions in his 2011 book, “The Great Stagnation“.

This analysis was supported by the property developers I met at a recent conference in Birmingham. They told me that indicators in their market today are the most positive they have been since the start of the 1980s property boom; but none of them expect that boom to be repeated. The market is far more cautious concerning medium and long-term prospects for growth.

We have passed permanently into an era of more modest economic growth than we have become accustomed to; or at very least into an era whereby we need to restructure the relationship between economic growth and the consumption of resources and energy in ways that we have not yet determined before higher growth does return. We have passed a tipping point; the world has changed.

(Growth in the world’s urban population as reported by “World Urbanization Prospects”, 2007 Revision, Department of Economic and Social Affairs, United Nations)

Tipping point 2: urbanisation and the industrialisation of food supply

As has been widely quoted in recent years, more than half the world’s population has lived in cities since 2010 according to the United Nations Department of Economic and Social Affairs. That percentage is expected to increase to 70% by 2050.

The implications of those facts concern not just where we live, but the nature of the economy. Cities became possible when we industrialised the production and distribution of food, rather than providing it for ourselves on a subsistence basis; or producing it in collaboration with our neighbours. For this reason, many developing nations still undergoing urbanisation and industrialisation – such as Tanzania, Turkmenistan and Tajikstan – still formally define cities by criteria including “the pre-dominance of non-agricultural workers and their families” (as referenced in the United Nations’ “World Urbanization Prospects” 2007 Revision).

So for the first time more than half the world’s population now lives in cities; and is provided with food by industrial supply chains rather than by families or neighbours. We have passed a tipping point; the world has changed.

(Estimated damage in $US billion caused by natural disasters between 1900 and 2012 as reported by EM-DAT)

Tipping point 3: the frequency and impact of extreme weather conditions

As our climate changes, we are experiencing more unusual and extreme weather. In addition to the devastating impact recently of Typhoon Haiyan in the Philippines, cities everywhere are regularly experiencing the effects to a more modest degree.

One city in the UK told me recently that inside the last 12 months they have dealt with such an increase in incidents of flooding severe enough to require coordinated cross-city action that it has become an urgent priority for local Councillors. We are working with other cities in Europe to understand the effect of rising average levels of flooding – historic building construction codes mean that a rise in average levels of a meter or more could put significant numbers of buildings at risk of falling down. The current prediction from the United Nations International Panel on Climate Change is that levels will rise somewhere between 26cm and 82cm by the end of this century – close enough for concern.

The EM-DAT International Disasters Database has calculated the financial impact of natural disasters over the past century. They have shown that in recent years the increased occurrence of unusual and extreme weather combined with the increasing concentration of populations and economic activity in cities has caused this impact to rise at previously unprecedented rates.

The investment markets have identified and responded to this trend. In their recent report “Global Investor Survey on Climate Change”, the Global Investor Coalition on Climate Change reported this year that 53% of fund managers collectively responsible for $14 trillion of assets indicated that they had divested stocks, or chosen not to invest in stocks, due to concerns over the impact of climate change on the businesses concerned. We have passed a tipping point; the world has changed.

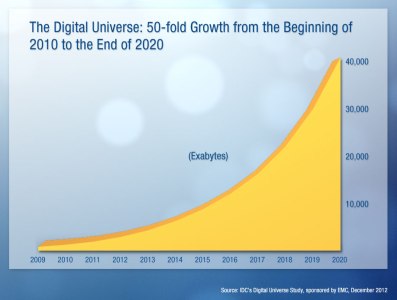

(The prediction of exponential growth in digital information from EMC’s Digital Universe report)

The dawn of the Information Revolution

Tipping point 4: exponential growth in the world’s most powerful man-made resource, digital information

Information has always been crucial to our world. Our use of language to share it is arguably a defining characteristic of what it means to be human; it is the basis of monetary systems for mediating the exchange of goods and services; and it is a core component of quantum mechanics, one of the most fundamental physical theories that describes how our universe behaves.

But the emergence of broadband and mobile connectivity over the last decade have utterly transformed the quantity of recorded information in the world and our ability to exploit it.

EMC’s Digital Universe report shows that in between 2010 and 2012 more information was recorded than in all of previous human history. They predict that the quantity of information recorded will double every 2 years, meaning that at any point in the next two decades it will be true to make the same assertion that “more information was recorded in the last two years than in all of previous history”. In 2011 McKinsey described the “information economy” that has emerged to exploit this information as a fundamental shift in the basis of the economy as a whole.

Not only that, but information has literally been turned into money. The virtual currency Bitcoin is based not on the value of a raw material such as gold whose availability is physically limited; but on the outcomes of extremely complex cryptographic calculations whose performance is limited by the speed at which computers can process information. The value of Bitcoins is currently rising incredibly quickly – from $20 to $1000 since January; although it is also subject to significant fluctuations.

Ultimately, Bitcoin itself may succeed or fail – and it is certainly used in some unethical and dangerous transactions as well as by ordinary people and businesses. But its model has demonstrated in principle that a decentralised, non-national, information-based currency can operate successfully, as my colleague Richard Brown recently explained.

Digital information is the most valuable man-made resource ever invented; it began a period of exponential growth just three years ago and has literally been turned into money. We have passed a tipping point; the world has changed.

(Images captured by MRI scan by Shinji Nishimoto, Alex G. Huth, An Vu and Jack L. Gallant, UC Berkley, 2011)

Tipping point 5: the disappearing boundary between humans, information and the physical world

In the 1990s the internet began to change the world despite the fact that it could only be accessed by using an expensive, heavy personal computer; a slow and inconvenient telephone modem; and the QWERTY keyboard that was designed in the 19th Century to prevent typists from typing faster than the levers in mechanical typewriters could move.

Three years ago, my then 2-year-old son taught himself how to use a touchscreen tablet to watch cartoons from around the world before he could read or write. Two years ago, Scientists at the University of California at Berkeley used a Magnetic Resonance Imaging facility to capture images from the thoughts of a person watching a film. A less sensitive mind-reading technology is already available as a headset from Emotiv, which my colleagues in IBM’s Emerging Technologies team have used to help a paralysed person communicate by thinking directional instructions to a computer.

Earlier this year, a paralysed woman controlled a robotic arm by thought; and prosthetic limbs, a working gun and living biological structures such as muscle fibre and skin are just some of the things that can be 3D printed on demand from raw materials and digital designs.

Our thoughts can control information in computer systems; and information in those systems can quite literally shape the world around us. The boundaries between our minds, information and the physical world are disappearing. We have passed a tipping point; the world has changed.

(A personalised prosthetic limb constructed using 3D printing technology. Photo by kerolic)

Tipping point 6: the miniaturisation of industry

The emergence of the internet as a platform for enabling sales, marketing and logistics over the last decade has enabled small and micro-businesses to reach markets across the world that were previously accessible only to much larger organisations with international sales and distribution networks.

More recently, the emergence and maturation of technologies such as 3D printing, open-source manufacturing and small-scale energy generation are enabling small businesses and community initiatives to succeed in new sectors by reducing the scale at which it is economically viable to carry out what were previously industrial activities – a trend recently labelled by the Economist magazine as the “Third Industrial Revolution“. The continuing development of social media and pervasive technology enable them to rapidly form and adapt supply and exchange networks with other small-scale producers and consumers.

Estimates of the size of the resulting “sharing economy“, defined by Wikipedia as “economic and social systems that enable shared access to goods, services, data and talent“, vary widely, but are certainly significant. The UK Economist magazine reports one estimate that it is a $26 billion economy already, whilst 2 Degrees Network report that just one aspect of it – small-scale energy generation – could save UK businesses £33 billion annually by 2030. Air B’n’B – a peer-to-peer accommodation service – reported recently that they had contributed $632 million in value to New York’s economy in 2012 by enabling nearly 5,000 residents to earn an average of $7,500 by renting their spare rooms to travellers; and as a consequence of those travellers additionally spending an average of $880 in the city during their stay. Overall, there has been a significant rise in self-employment and “micro-entrepreneurial” enterprises over the last few years, which now account for 14% of the US economy.

Organisations participating in the sharing economy exhibit a range of motivations and ethics – some are aggressively commercial, whilst others are “social enterprises” with a commitment to reinvest profits in social growth. The social enterprise sector, comprised of mutuals, co-operatives, employee-owned businesses and enterprises who submit to “triple bottom line” accounting of financial, social and environmental capital, is about 15% of the value of most economies, and has been growing and creating jobs faster than traditional business since the 2008 crash.

In the first decade of the 21st Century, mobile and internet technologies caused a convergence between the technology, communications and media sectors of the economy. In this decade, we will see far more widespread disruptions and convergences in the technology, manufacturing, creative arts, healthcare and utilities industries; and enormous growth in the number of small and social enterprises creating innovative business models that cut across them. We have passed a tipping point; the world has changed.

Rebalancing the world

(Lake Kutubu, Papua New Guinea, where Chevron’s oilfield operations were designed in collaboration with the local community. Photo by Iain Taylor)

Tipping point 7: how we respond to climate change and resource constraints

There is now agreement amongst scientists, expressed most conclusively by the United Nations International Panel on Climate Change this year, that the world is undergoing a period of overall warming resulting from the impact of human activity. But there is not yet a consensus on how we should respond.

Views vary from taking immediate, sweeping measures to drastically cut carbon and greenhouse gas emissions, to the belief that we should accept climate change as inevitable and focus investment instead on adapting to it, as suggested by the “Skeptical Environmentalist” Bjørn Lomborg and the conservative think-tank the American Enterprise Institute. As a result of this divergence of opinion, and of the challenge of negotiating between the interests of countries, communities and businesses across the world, the agreement reached by last year’s climate change negotiations in Doha was generally regarded as relatively weak.

Professor Chris Rogers of the University of Birmingham and his colleagues in the Urban Futures initiative have assessed over 450 proposed future scenarios and identified four archetypes (described in his presentation to Base Cities Birmingham) against which they assess the cost and effectiveness of environmental and climate interventions. The “Fortress World” scenario is divided between an authoritarian elite who control the world’s resources from their protected enclaves and a wider population living in poverty. In “Market Forces”, free markets encourage materialist consumerism to wholly override social and environmental values; whilst in “Policy Reform” a combination of legislation and citizen behaviour change achieve a balanced outcome. And in the “New Sustainability Paradigm” the pursuit of wealth gives way to a widespread aspiration to achieve social equality and environmental sustainability. (Chris is optimistic enough that his team dismissed another scenario, “Breakdown”, as unrealistic).

Decisions that are taken today affect the degree to which our world will evolve to resemble those scenarios. As the impact of weather and competition for resources affect the stability of supply of energy and food, many cities are responding to the relative lack of national and international action by taking steps themselves. Some businesses are also building strategies for long-term success and profit growth around sustainability; in part because investing in a resilient world is a good basis for a resilient business, and in part because they believe that a genuine commitment to sustainability will appeal to consumers. Unilever demonstrated that they are following this strategy recently by committing to buy all of their palm oil – of which they consume one third of the world’s supply – from traceable sources by the end of 2014.

At some point, we will all – individuals, businesses, communities, governments – be forced to change our behaviour to account for climate change and the limits of resource availability: as the prices of raw materials, food and energy rise; and as we are more and more directly affected by the consequences of a changing environment.

The questions are: to what extent have these challenges become urgent to us already; and how and when will we respond?

(“Makers” at the Old Print Works in Balsall Heath, Birmingham, sharing the tools, skills and ideas that create successful small businesses)

Tipping point 8: the end of the average career

In “The End of Average“, the economist Tyler Cowen observed that about 60% of the jobs lost during the 2008 recession were in mid-wage occupations; and the UK Economist magazine reported that many jobs lost from professional industries had been replaced in artisan trades and small-scale industry such as food, furniture and design.

Echoing Jeremy Grantham, Cowen further observes that these changes take place within a much longer term 28% decline in middle-income wages in the US between 1969 and 2009 which has no identifiable single cause. Cowen worries that this is a sign that the economy is beginning to diverge into the authoritarian elite and the impoverished masses of Chris Rogers’ “Fortress World” scenario.

Other evidence points to a more complex picture. Jake Dunagan, Research Director of the Institute for the Future, believes that the widespread availability of digital technology and information is extending democracy and empowerment – just as the printing press and education did in the last millennium as they dramatically increased the extent to which people were informed and able to make themselves heard. Dunagan notes that through our reliance on technology and social media to find and share information, our thoughts and beliefs are already formed by, and having an effect on, society in a way that is fundamentally new.

The miniaturisation of industry (tipping point 6 above) and the disappearance of the boundary between our minds and bodies, information and the physical world (tipping point 5 above) are changing the ways in which resources and value are exchanged and processed out of all recognition. Just imagine how different the world would be if a 3D-printing service such as Shapeways transformed the manufacturing industry as dramatically as iTunes transformed the music industry 10 years ago. Google’s futurologist Thomas Frey recently described 55 “jobs of the future” that he thought might appear as a result.

(Activities comprising the “Informal Economy” and their linkages to the mainstream economy, by Claro Partners)

In both developed and emerging countries, informal, social and micro-businesses are significant elements of the economy, and are growing more quickly than traditional sectors. Claro partners estimate that the informal economy (in which they include alternative currencies, peer-to-peer businesses, temporary exchange networks and micro-businesses – see diagram, right) is worth $10 trillion worldwide, and that it employs up to 80% of the workforce in emerging markets.

In developed countries, the Industrial Revolution drove a transformation of such activity into a more formal economy – a transformation which may now be in part reversing. In developing nations today, digital technology may make part of that transformation unnecessary.

To be successful in this changing economy, we will need to change the way we learn, and the way we teach our children. Cowen wrote that “We will move from a society based on the pretense that everyone is given an okay standard of living to a society in which people are expected to fend for themselves much more than they do now”; and expressed a hope that online education offers the potential for cheaper and more widespread access to new skills to enable people to do so. This thinking echoes a finding of the Centre for Cities report “Cities Outlook 1901” that the major factor driving the relative success or failure of UK cities throughout the 20th Century was their ability to provide their populations with the right skills at the right time as technology and industry developed.

The marketeer and former Yahoo Executive Seth Godin’s polemic “Stop Stealing Dreams” attacked the education system for continuing to prepare learners for stable, traditional careers rather than the collaborative entrepreneurialism that he and other futurists expect to be required. Many educators would assert that their industry is already adapting and will continue to do so – great change is certainly expected as the ability to share information online disrupts an industry that developed historically to share it in classrooms and through books.

Many of the businesses, jobs and careers of 2020, 2050 and 2100 will be unrecognisable or even unimaginable to us today; as are the skills that will be needed to be successful in them. Conversely, many post-industrial cities today are still grappling with challenges created by the loss of jobs in manufacturing, coalmining and shipbuilding industries in the last century.

The question for our future is: will we adapt more comfortably to the sweeping changes that will surely come to the industries that employ us today?

(“Lives on the Line” by James Cheshire at UCL’s Centre for Advanced Spatial Analysis, showing the variation in life expectancy and correlation to child poverty in London. From Cheshire, J. 2012. Lives on the Line: Mapping Life Expectancy Along the London Tube Network. Environment and Planning A. 44 (7). Doi: 10.1068/a45341)

The benefits of living in cities are distributed extremely unevenly.

The difference in life expectancy of children born into the poorest and wealthiest areas of UK cities today is often as much as 20 years – for boys in Glasgow the difference is 28 years. That’s a deep inequality in the opportunity to live.

There are many causes of that inequality, of course: health, diet, wealth, environmental quality, peace and public safety, for example. All of them are complex, and the issues that arise from them to create inequality – social deprivation and immobility, economic disengagement, social isolation, crime and lawlessness – are notoriously difficult to address.

But a fundamental element of addressing them is choosing to try to do so. That’s a trite observation, but it is nonetheless the case that in many of our activities we do not make that choice – or, more accurately, as individuals, communities and businesses we take choices primarily in our own interests rather than based on their wider impact.

Writing about cities in the 1960s, the urbanist Jane Jacobs observed that:

“Private investment shapes cities, but social ideas (and laws) shape private investment. First comes the image of what we want, then the machinery is adapted to turn out that image. The financial machinery has been adjusted to create anti-city images because, and only because, we as a society thought this would be good for us. If and when we think that lively, diversified city, capable of continual, close- grained improvement and change, is desirable, then we will adjust the financial machinery to get that.”

In many respects, we have not shaped the financial machinery of the world to achieve equality. Nobel Laureate Joseph Stiglitz wrote recently that in fact the financial machinery of the United States and the UK in particular create considerable inequality in those countries; and the Economist magazine reminds us of the enormous investments made into public institutions in the past in order to distribute the benefits of the Industrial Revolution to society at large rather than concentrate them on behalf of business owners and the professional classes – with only partial success.

New legislation in banking has been widely debated and enacted since the 2008 financial crisis – enforcing the separation of commercial and investment banking, for example. But addressing inequality is a much broader challenge than the regulation of banking, and will not only be addressed by legislation. Business models such as social enterprise, cross-city collaborations and the sharing economy are emerging to develop sustainable businesses in industries such as food, energy, transportation and finance, in addition to the contribution made by traditional businesses building sustainability into their strategies.

Whenever we vote, buy something or make a choice in business, we contribute to our overall choice to develop a fairer, more sustainable world in which everyone has a chance to participate. The question is not just whether we will take those choices; but the degree to which their impact on the wider world will be apparent to us so that we can do so in an informed way.

That is a challenge that technology can help with.

(A smartphone alert sent to a commuter in a San Francisco pilot project by IBM Research and Caltrans that provides personalised daily predictions of commuting journey times. The predictions gave commuters the opportunity to take a better-informed choice about their travel to work.)

Data and Choice

Like the printing press, the vote and education, access to data allows us to make more of a difference than we were able to without it.

Niall Firth’s November editorial for the New Scientist magazine describes how citizens of developing nations are using open data to hold their governments to account, from basic information about election candidates to the monitoring of government spending. In the UK, a crowd-sourced analysis of politicians’ expenses claims that had been leaked to the press resulted in resignations, the repayment of improperly claimed expenses, and in the most severe cases, imprisonment.

Unilever are committing to making their supply chain for palm oil traceable precisely because that data is what will enable them to next improve its sustainability; and in Almere, city data and analytics are being used to plan future development of the city in a way that doesn’t cause harmful impacts to existing citizens and residents. Neither initiative would have been possible or affordable without recent improvements in technology.

Data and technology, appropriately applied, give us an unprecedented ability to achieve our long-term objectives by taking better-informed, more forward-looking decisions every day, in the course of our normal work and lives. They tell us more than we could ever previously have known about the impact of those decisions.

That’s why the tipping points I’ve described in this article matter to me. They translate my general awareness that I should “do the right thing” into a specific knowledge that at this point in time, my choices in many aspects of daily work and life contribute to powerful forces that will shape the next century that we share on this planet; and that they could help to tip the balance in all of our favour.

Pingback: Rick Robinson - innovateuk

Very good and well researched article. You’re more optimistic than I am though – one Unilever doesn’t a summer make to scramble a cliche. Its positive that some corporates are waking up to their social responsibilities, but here’s another tipping point – the trade agreement between the US and the EU will enable corporates to hold private courts which will overrule, where necessary, local law. That frightens me more than almost anything else I’ve seen in modern politics.

http://www.theguardian.com/commentisfree/2013/dec/02/transatlantic-free-trade-deal-regulation-by-lawyers-eu-us

LikeLike

Thanks Chris,

Well, I’m certainly an optimist 🙂

But I don’t think we have all the answers, either. For me the real challenge is that whilst a strategy such as that which Unilever is following is linking profit growth with sustainability, the investment markets will by and large concentrate only on their profitability – the investment report I cited in the article concludes only that investors are avoiding businesses that are at risk from climate change; not that they are (as a rule) investing in corporations contributing to avoiding or minimising it.

There are quite a number of companies following such strategies to one extent or another – 2 Degrees network (https://www.2degreesnetwork.com/) and Sustainable Brands (http://www.sustainablebrands.com/) report regularly on their work in that field, for example. But in the absence of changes to policy, ultimately it’s down to us as consumers to make these strategies work, which is one of the reasons I blog about them!

Thanks for that link to the trade negotiations – I’ll have a look at that now,

Cheers,

Rick

LikeLike

Pingback: Information and choice: nine reasons our future is in the balance | wmodf

Pingback: Six ways to design humanity and localism into Smart Cities | The Urban Technologist

Pingback: No-one wants top-down, technology-driven cities. They’d be dumb, not smart. | The Urban Technologist

Pingback: 6 inconvenient truths about Smart Cities | The Urban Technologist

Pingback: Why Smart Cities still aren’t working for us after 20 years. And how we can fix them. | The Urban Technologist

Pingback: Rick Robinson, “Why Smart Cities still aren’t working for us after 20 years. And how we can fix them” | Green Digital Charter

Pingback: Information and choice: nine reasons our future is in the balance | West Midlands Open Data Forum